UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934 (Amendment

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

National Instruments Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

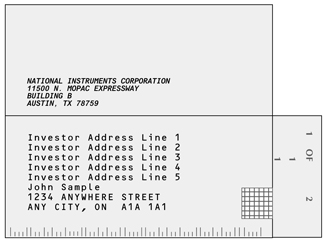

NATIONAL INSTRUMENTS CORPORATION

Notice of 2016 Annual Meeting of Stockholders

May 14, 2013

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) of National Instruments Corporation, a Delaware corporation (“NI”), will be held on May 14, 2013, at 9:00 a.m. local time, at NI’s principal executive offices located at 11500 North Mopac Expressway, Building C, Austin, Texas 78759 for the following purposes as more fully described in the Proxy Statement accompanying this Notice:

1. To elect each of Dr. James J. Truchard and Mr. John M. Berra to the Board of Directors for a term of three years.

2. To approve an amendment of NI’s Certificate of Incorporation to increase the authorized number of shares of Common Stock by 180,000,000.

3. To ratify the appointment of Ernst & Young as NI’s independent registered public accounting firm for the fiscal year ending December 31, 2013.

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on March 15, 2013, are entitled to receive notice of and to vote at the meeting.

Date and Time: | Tuesday, May 10, 2016 9:00 A.M., local time | |

Place: | NI’s principal executive offices 11500 North Mopac Expressway, Building C Austin, Texas 78759 | |

Business: | 1. To elect each of Dr. James J. Truchard and Mr. John M. Berra to the Board of Directors for a term of three years. | |

2. To ratify the appointment of Ernst & Young LLP as NI’s independent registered public accounting firm for the fiscal year ending December 31, 2016. | ||

3. To transact such other business as may properly come before the meeting or any adjournment thereof. | ||

Record Date: | Only stockholders of record at the close of business on March 11, 2016, are entitled to receive notice of and to vote at the meeting. | |

Voting By Proxy: | All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend the Annual Meeting, we hope that you will vote as soon as possible. You may vote on the Internet or by telephone by following the instructions provided in the Notice of Internet Availability of Proxy Materials you received in the mail. If you received a paper copy of a proxy card by mail in response to your request for a hard copy of the proxy materials for the Annual Meeting, you may also vote by Internet, telephone, or by completing, signing and dating your proxy card and mailing it in the postage-prepaid envelope enclosed for that purpose, in each case by following the instructions on the proxy card. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting, if you do not attend in person. For specific instructions on how to vote your shares, please review the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or the proxy card if you received a paper copy of the proxy materials. Stockholders attending the Annual Meeting may vote in person even if they have submitted a proxy. However, if you have submitted a proxy and wish to vote at the Annual Meeting, you must notify the inspector of elections of your intention to revoke the proxy you previously submitted and instead vote in person at the Annual Meeting. If your shares are held in the name of a broker, trustee, bank or other nominee, please bring a proxy from the broker, trustee, bank or other nominee with you to confirm you are entitled to vote the shares. | |

Sincerely,

/s/ David G. Hugley

Vice President, General Counsel, Secretary

Austin, Texas

April 1, 2013March 31, 2016

PROXY STATEMENT

NATIONAL INSTRUMENTS CORPORATION

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

The Board of Directors (the “Board”) of National Instruments Corporation, a Delaware corporation (“NI”), has made proxy materials available to you on the Internet or, upon your request, has delivered printed versions of proxy materials to you by mail, in connection with the Board’s solicitation of proxies for use at NI’s 20132016 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 14, 2013,10, 2016, at 9:00 a.m., local time, or at any adjournments or postponements thereof, for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at NI’s principal executive offices at 11500 North Mopac Expressway, Building C, Austin, Texas 78759. NI’s telephone number is (512) 338-9119.

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), NI is now furnishing proxy materials to NI’s stockholders on the Internet, rather than mailing printed copies of those materials to each stockholder. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. We anticipate that the Notice of Internet Availability of Proxy Materials will be mailed to stockholders on or about April 1, 2013.March 31, 2016.

Householding of Annual Meeting Materials

Some brokers and other nominee record holders may be participating in the practice of “householding” notices of Internet availability of proxy materials, proxy statements and annual reports. This means that only one (1) copy of the Notice of Internet Availability of Proxy Materials may have been sent to multiple stockholders in a stockholder’s household. We will promptly deliver a separate copy of any of these documents to any stockholder who contacts our investor relations department at 11500 North Mopac Expressway, Austin, Texas 78759-3504, (512) 683-5090, requesting such copies. If a stockholder is receiving multiple copies of the Notice of Internet Availability of Proxy Materials or the printed versions of such other accounts at the stockholder’s household and would like to receive a single copy of these documents for a stockholder’s household in the future, stockholders should contact their broker, other nominee record holder, or our investor relations department to request mailing of a single copy of any of these documents.

Record Date; Outstanding Shares

Stockholders of record at the close of business on March 15, 201311, 2016 (the “Record Date”) are entitled to receive notice of and vote at the Annual Meeting. On the Record Date, 123,502,067127,822,071 shares of NI’s common stock, $0.01 par value, were issued and outstanding.

1

Every stockholder of record on the Record Date is entitled, for each share held, to one vote on each proposal that comes before the Annual Meeting. In the election of directors in Proposal One, each stockholder will be entitled to vote for two nominees and the two nominees with the greatest number of votes will be elected. Beginning with the Annual Meeting,However, any nominee for director in an uncontested election who receives a

greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation following certification of the stockholder vote. See “Proposal One: Election of Directors—Vote Required; Recommendation of Board of Directors” for additional information on these guidelines.

The affirmative vote of the holders of a majority of the shares of Common Stock issued and outstanding on the Record Date will be required to approve Proposal Two. The affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting will be required to approve Proposal Three.Two.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may vote on the Internet, by telephone or, if you received a paper copy of the proxy materials, by completing, signing and mailing the proxy card enclosed therewith in the postage-prepaid envelope provided for that purpose. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting, if you do not attend in person. For specific instructions on how to vote your shares, please review the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or the proxy card if you received a paper copy of the proxy materials.

The cost of this solicitation will be borne by NI. NI may reimburse expenses incurred by brokerage firms and other persons representing beneficial owners of shares in forwarding solicitation materials to beneficial owners. Proxies may be solicited by certain of NI’s directors, officers and other employees, without additional compensation, personally, by telephone or by email.

Treatment of Abstentions and Broker Non-Votes

Abstentions will be counted for purposes of determining (i) either the presence or absence of a quorum for the transaction of business and (ii) the total number of votes cast with respect to a proposal (other than the election of directors). Accordingly, abstentions will have no effect on the election of directors in Proposal One, and abstentions will have the same effect ofas a vote against Proposals Two and Three.Proposal Two.

While broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, broker non-votes will not be counted for purposes of determining the number of votes cast with respect to the particular proposal on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of the voting on Proposals One or Three and will have the effect of a vote against Proposal Two.

A broker will vote your shares only if the proposal is a matter on which your broker has discretion to vote (such as the ratification of our independent registered public accounting firm in Proposal Three)Two), or if you provide instructions on how to vote by following the instructions provided to you by your broker.

2

Proxies given pursuant to this solicitation may be revoked at any time before they have been used. You may change or revoke your proxy by entering a new vote by Internet or by telephone or by delivering a written notice of revocation to the Secretary of NI or by completing a new proxy card bearing a later date (which automatically revokes the earlier proxy instructions). Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request by notifying the inspector of elections of your intention to revoke your proxy and voting in person at the Annual Meeting.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS

Stockholders of NI may submit proper proposals for inclusion in NI’s Proxy Statement and for consideration at the annual meeting of stockholders to be held in 20142017 by submitting their proposals in writing to the Secretary of NI in a timely manner. In order to be considered for inclusion in NI’s proxy materials for the annual meeting of stockholders to be held in 2014,2017, stockholder proposals must be

received by the Secretary of NI no later than December 2, 2013,1, 2016, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In addition, NI’s bylaws establish an advance notice procedure with regard to business to be brought before an annual meeting, including stockholder proposals not included in NI’s Proxy Statement. For director nominations or other business to be properly brought before NI’s 20142017 annual meeting by a stockholder, such stockholder must deliver written notice to the Secretary of NI at NI’s principal executive office no later than January 31, 201430, 2017 and no earlier than January 1, 2014.December 31, 2016. If the date of NI’s 20142017 annual meeting is advanced or delayed by more than 30 calendar days from the first anniversary date of the 20132016 Annual Meeting, your notice of a proposal will be timely if it is received by NI by the close of business on the tenthlater of (i) the 90th day prior to the 2017 annual meeting and (ii) the 10th day following the day NI first publicly announces the date of the 20142017 annual meeting.

The proxy grants the proxy holders discretionary authority to vote on any matter raised at the Annual Meeting. If a stockholder fails to comply with the foregoing notice provisions, proxy holders will be allowed to use their discretionary voting authority on such matter should the stockholder proposal come before the 20142017 annual meeting.

A copy of the full text of the bylaw provisions governing the notice requirements set forth above may be obtained by writing to the Secretary of NI. All notices of proposals and director nominations by stockholders should be sent to National Instruments Corporation, 11500 North Mopac Expressway, Building C, Austin, Texas 78759, Attention: Corporate Secretary.

3

ELECTION OF DIRECTORS

NI’s Board of Directors is divided into three classes, with the term of the office of one class expiring each year. The authorized number of directors which constitutes the entire Board of Directors is currently seven,eight, with two directors in Class I, three directors in Class II, and twothree directors in Class III.

The terms of office of Class I directors Dr. James J. Truchard and Mr. John M. Berra will expire at the Annual Meeting. NI’s Board of Directors has nominated Dr. James J. Truchard and Mr. John M. Berra will stand for re-election to the Board of Directorselection as Class I directors at the Annual Meeting. The terms of office of Class II directors Mr. Jeffrey L. Kodosky, Dr. Donald M. Carlton and Mr. John K. MedicaMichael E. McGrath will expire at the 20142017 annual meeting. The terms of office of Class III directors Ms. Duy-Loan T. Le, and Mr. Charles J. Roesslein and Dr. Gerhard Fettweis will expire at the 20152018 annual meeting.

Under the listing requirements of the Nasdaq Stock Market (“Nasdaq”), a majority of the Board of Directors must be comprised of independent directors. The Board of Directors has determined that each of Mr. Berra, Dr. Carlton, Ms. Le, Mr. MedicaMcGrath, Mr. Roesslein and Mr. RoessleinDr. Fettweis is independent under applicable Nasdaq listing standards and Rule 10A-3 of the Securities Exchange Act of 1934.

Vote Required; Recommendation of Board of Directors

The nominees receiving the highest number of affirmative votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote in the election of directors shall be elected to the Board of Directors. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum, but have no legal effect under Delaware law. Cumulative voting is not permitted by NI’s Certificate of Incorporation.

Beginning with the Annual Meeting,Under NI’s Corporate Governance Guidelines, any nominee for director in an uncontested election (i.e., an election where the only nominees are those recommended by the Board) who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation following certification of the stockholder vote.

TheIn such event, the Nomination and Governance Committee will promptly consider the tendered resignation and will recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the “withheld” votes. In making this recommendation, the Nomination and Governance Committee will consider all factors deemed relevant by its members including, without limitation, the underlying reasons why stockholders “withheld” votes for election from such director (if ascertainable), the length of service and qualifications of the director whose resignation has been tendered, the director’s contributions to NI, whether by accepting such resignation NI will no longer be in compliance with any applicable law, rule, regulation or governing document, and whether or not accepting the resignation is in the best interests of NI and its stockholders.

The Board will promptly act on the Nomination and Governance Committee’s recommendation no later than 90 days following its receipt of such recommendation. In considering the Nomination and Governance Committee’s recommendation, the Board will consider the factors considered by the Nomination and Governance Committee and such additional information and factors the Board believes to be relevant.

4

Unless otherwise instructed, the proxy holders will vote the proxies received by them for NI’s nominees named below. If any nominee of NI is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the present Board of Directors

to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEThe Board Of Directors unanimously recommends a vote “FOR” THE NOMINEES LISTED BELOW.the nominees listed below.

Nominees for Election at the Annual Meeting

The Nomination and Governance Committee, consisting solely of independent directors as determined under applicable Nasdaq listing standards, recommended the two individuals set forth in the table below for nomination by our full Board of Directors. Based on such recommendation, our Board of Directors nominated such directors for election at the Annual Meeting. The following sets forth information concerning the nominees for election as directors at the Annual Meeting, including information as to each nominee’s age as of the Record Date, current principal occupation and business experience.

Name of Nominee | Age | Position/Principal Occupation | Director Since | |||||||

James J. Truchard | 69 | Chairman of the Board of Directors and Chief Executive Officer and President of NI | 1976 | |||||||

John M. Berra (1) (2) (3) | 65 | Director; Former Chairman of Emerson Process Management and Former Executive Vice President of Emerson Electric Company | 2010 | |||||||

| James J. Truchard, PhD, 72 - Chairman of the Board of Directors and Chief Executive Officer and President of NI since 1976. Business Experience: Dr. Truchard co-founded NI in 1976. From 1963 to 1976, Dr. Truchard worked at the Acoustical Measurements Division at Applied Research Laboratories (“ARL”) at the University of Texas at Austin (“UT Austin”), as Research Scientist and later Division Head. Dr. Truchard received his PhD in Electrical Engineering, his master’s degree in Physics and his bachelor’s degree in Physics, all from UT Austin. The Board concluded that Dr. Truchard should serve as a director because he is a founder and large stockholder of NI and has pioneered the development of virtual instrumentation software and hardware. Further, the Board recognizes that under Dr. Truchard’s leadership as a Board member and as CEO, he has inspired innovation, growth, and expansion over a period of over 30 years to make NI a highly successful, worldwide enterprise while maintaining an entrepreneurial spirit. |

| John M. Berra, 68 - Director since May 2010; Former Chairman of Emerson Process Management and Former Executive Vice President of Emerson Electric Company. Business Experience: Prior to retiring in September 2010, beginning in October 2008 Mr. Berra served as Chairman of Emerson Process Management, a global leader in providing solutions to customers in process control, and as Executive Vice President of Emerson Electric Company. From 1997 until 2008, he served as President of Emerson Process Management. Mr. Berra has diversified experience in global business, strategic planning, technology, organizational planning and acquisitions. Mr. Berra joined Emerson’s Rosemount division as a marketing manager in 1976 and, thereafter, continued assuming more prominent roles in the organization until 1997, when he was named President of Emerson’s Fisher-Rosemount division (now Emerson Process Management). Prior to joining Emerson, Mr. Berra was an instrument and electrical engineer with Monsanto Company. Mr. Berra is currently a director of Ryder System, Inc., a publicly traded company, and serves as a member of that company’s compensation committee, and as a member of its finance committee. The Board concluded that Mr. Berra should serve as a director due to his significant executive level experience at leading corporations Emerson and Monsanto. In particular, as President of Emerson Process Management, he was chief executive of a $6.7 billion dollar global corporation. He has extensive experience growing large accounts and broad based sales and marketing experience concentrated in a number of markets. He also has extensive experience in hardware development of measurement products and control systems and software dealing with PC software and embedded applications. In 2015, he served as a member of the Audit Committee, |

James J. Truchard, PhDco-founded NI in 1976 and has served as its Chief Executive Officer, President and Chairman of the Board of Directors since inception. From 1963 to 1976, Dr. Truchard worked at the Acoustical Measurements Division at Applied Research Laboratories (“ARL”) at the University of Texas at Austin (“UT Austin”), as Research Scientist and later Division Head. Dr. Truchard received his PhD in Electrical Engineering, his master’s degree in Physics and his bachelor’s degree in Physics, all from UT Austin.

The Board concluded that Dr. Truchard should serve as a director since he is a founder and large stockholder of NI and has pioneered the development of virtual instrumentation software and hardware. Further, the Board recognizes that under Dr. Truchard’s leadership as a Board member and as CEO, he has inspired innovation, growth, and expansion over a period of over 30 years to make NI a highly successful, worldwide enterprise while maintaining an entrepreneurial spirit.

John M. Berra has been a member of NI’s Board of Directors since May 2010. From October 2008 through September 2010, Mr. Berra served as Chairman of Emerson Process Management, a global leader in providing solutions to customers in process control, and as Executive Vice President of Emerson Electric Company. From 1997 until 2008, he served as President of Emerson Process Management. Mr. Berra has diversified experience in global business, strategic planning, technology, organizational planning and acquisitions. Mr. Berra joined Emerson’s Rosemount division as a

5

marketing manager in 1976 and, thereafter, continued assuming more prominent roles in the organization until 1997, when he was named President of Emerson’s Fisher-Rosemount division (now Emerson Process Management). Prior to joining Emerson, Mr. Berra was an instrument and electrical engineer with Monsanto Company. Mr. Berra is currently a director of Ryder System, Inc., and serves as a member of that company’s compensation committee, and as a member of its finance committee.

The Board concluded that Mr. Berra should serve as a director due to his significant executive level experience at leading corporations Emerson and Monsanto. In particular, as President of Emerson Process Management, he was chief executive of a $6.7-billion dollar global corporation. He has extensive experience growing large accounts and broad based sales and marketing experience concentrated in a number of markets. He also has extensive experience in hardware development of measurement products and control systems and software dealing with PC software and embedded applications.

INCUMBENT DIRECTORS WHOSE TERMS OF OFFICE

CONTINUE AFTER THE ANNUAL MEETING

The following sets forth information concerning the directors whose terms of office continue after the Annual Meeting, including information as to each director’s age as of the Record Date, current principal occupation and business experience.

Name of Director | Age | Position/Principal Occupation | Director Since | |||||||

Jeffrey L. Kodosky | 63 | Director; Fellow of NI | 1976 | |||||||

Donald M. Carlton (1) (3) | 75 | Director; Former President and Chief Executive Officer of Radian International LLC | 1994 | |||||||

Charles J. Roesslein (1) (3) | 64 | Director; Former Chairman of the Board of Directors and President of Prodigy Communications Corporation | 2000 | |||||||

Duy-Loan T. Le (2) | 50 | Director; Senior Fellow of Texas Instruments, Inc. | 2002 | |||||||

John K. Medica (2) | 54 | Director; Former Senior Vice President and Co-Leader, Product Group at Dell, Inc. | 2008 | |||||||

| Jeffrey L. Kodosky, 66 - Director since 1976; Fellow of NI. Business Experience: Mr. Kodosky co-founded NI in 1976. He was appointed Vice President of NI in 1978 and served as Vice President, Research and Development from 1980 to 2000. Since 2000, he has held the position of Business and Technology Fellow. Prior to 1976, he was employed at ARL, at UT Austin. Mr. Kodosky received his bachelor’s degree in Physics from Rensselaer Polytechnic Institute. The Board concluded that Mr. Kodosky should serve as a director since he is a founder of NI, a highly respected mentor in the NI global R&D organization and he continues to chart new directions for NI’s flagship product, LabVIEW. Mr. Kodosky has developed more than 30 patented LabVIEW technologies and his ongoing work has helped NI grow this software into an award-winning industry programming environment that addresses a variety of industries and application areas. |

| Donald M. Carlton, PhD, 78 - Director since May 1994; Former President and Chief Executive Officer of Radian International, LLC. Business Experience: Prior to retiring in December 1998, beginning in February 1996 Dr. Carlton served as the President and Chief Executive Officer of Radian International LLC, and from 1969 until January 1996, Dr. Carlton served as President and Chairman of the Board of Radian Corporation, both of which are environmental engineering firms. Dr. Carlton received his bachelor’s degree in Chemistry from the University of St. Thomas and his PhD in Chemistry from UT Austin. Dr. Carlton is a former director of American Electric Power and Temple-Inland, Inc., publicly traded companies. The Board concluded that Dr. Carlton should serve as a director since he has a broad background as an executive and has significant experience in sales, which is key to NI. He also has experience in the development of large accounts, marketing strategies, chemical process development, supply chain and inventory management, accounting and compliance with SEC matters, all of which skills the Board believes are important to have represented on the NI Board. In 2015, he served as a member of the Audit Committee |

Jeffrey L. Kodosky co-founded NI in 1976 and has been a member of NI’s Board of Directors since that time. He was appointed Vice President of NI in 1978 and served as Vice President, Research and Development from 1980 to 2000. Since 2000, he has held the position of Business and Technology Fellow. Prior to 1976, he was employed at ARL, UT Austin. Mr. Kodosky received his bachelor’s degree in Physics from Rensselaer Polytechnic Institute.

The Board concluded that Mr. Kodosky should serve as a director since he is a founder of NI, a highly respected mentor in the NI global R&D organization and he continues to chart new directions for NI’s flagship product, LabVIEW. Mr. Kodosky has developed more than 30 patented LabVIEW technologies and his ongoing work has helped NI grow this software into an award-winning industry programming environment that addresses a variety of industries and application areas.

| Michael E. McGrath, 66 - Director since May 2014; Former Chief Executive Officer of i2 Technologies and Pittiglio Rabin Todd & McGrath, Business Strategy Consultant. Business Experience: Mr. McGrath is a highly experienced executive, entrepreneur and bestselling author dealing with decision making techniques and processes. He is a frequent featured guest on business television segments and his advice has appeared in many publications. He served as a director of i2 Technologies, a supply chain management and software services company, from September 2004 to May 2008, and as its CEO and President from February 2005 to July 2007. He served on the board of directors of Entrust, Inc., from February 2007, and as Chairman of the Board starting in November 2008, until the company was sold in July 2009. He served as executive chairman of the board of The Thomas Group from February 2008 to March 2012, and as acting CEO for a period of time. The Thomas Group filed for bankruptcy protection in March 2012. He also served on the board of Sensable Technologies from 2000 until 2009 and served on the board of Revolution Analytics from 2014 until 2015. He was a founder and the Chief Executive Officer of Pittiglio Rabin Todd & McGrath, a management consulting firm, for 28 years, retiring from the firm in July 2004. Mr. McGrath is the author of Product Strategy for High-Technology Companies, Next Generation Product Development, Business Decisions, and other books. Mr. McGrath received his bachelor’s degree in Computer Science from Boston College, and his master’s degree in Business Administration from Harvard Business School. The Board concluded that Mr. McGrath should serve as a director because he has an extensive background in product development strategy, strategic product marketing, and software services. Having served as CEO of i2 Technologies, a vendor of supply chain management software, he has knowledge of software systems, experience selling into corporate opportunities, and experience developing large accounts. In particular, he has experience with management functions including software marketing and sales force management activities, and software development. He is an experienced consultant and author with knowledge of cloud computing and smartmobile applications, which are relevant for NI’s business. In 2015, he served as a member of the Compensation Committee. He currently serves as a member of the Audit Committee, a member of the Compensation Committee and a member of the Nomination and Governance Committee. |

Donald M. Carlton, PhD, has been a member of NI’s Board of Directors since 1994. From February 1996 until December 1998, Dr. Carlton served as the President and Chief Executive Officer of Radian International LLC, and from 1969 until January 1996, Dr. Carlton served as President and

| Duy-Loan T. Le, 53 - Director since September 2002; Senior Fellow of Texas Instruments, Inc. Business Experience: Ms. Le holds the title of Senior Fellow at Texas Instruments Inc. (“TI”), one of the leading semiconductor companies in the world. Ms. Le was appointed Senior Fellow in 2002 and is the only woman in TI’s history elected to this highest Fellow rank. She has held various leadership positions at TI since 1982, including Advanced Technology Ramp Manager for the Embedded Processing Division and worldwide project manager for the Memory Division. While at TI, Ms. Le has led all aspects of execution for advanced technology nodes, including design, assembly and test, productization, qualification, release to market, high volume ramp, and quality and reliability assurance. She has experience opening international offices and developing engineering talent for the TI business. Ms. Le has been awarded 24 patents. She holds a bachelor’s degree in Electrical Engineering from UT Austin and a master’s degree in Business Administration from the Bauer College of Business at the University of Houston. The Board concluded that Ms. Le should serve as a director because she has extensive experience managing platform-based product development and is a results-oriented and highly accomplished technology executive with extensive experience in various aspects of semiconductor design and manufacture, including operations, research and development, product launch, customer interfacing, foundry partnership, and supply chain management while at TI. She also managed global R&D centers for TI and these centers span multiple countries, disciplines, businesses, and organizations across TI. She has over 20 years of process manufacturing experience. These skills and knowledge are relevant for NI’s business. In 2015, she served as a member of the Compensation Committee. She currently serves as a member of the Audit Committee, a member of the Compensation Committee and a member of the Nomination and Governance Committee. |

| Charles J. Roesslein, 67 - Director since July 2000; Former Chief Executive Officer of Austin Tele-Services, LLC. Business Experience: Mr. Roesslein was the co-founder and Chief Executive Officer of Austin Tele-Services, LLC, which is in the secondary market for telecom and IT assets, from 2004 until 2016 when his interests were sold. During 2000, Mr. Roesslein served as the Chairman of the Board of Directors and President of Prodigy Communications Corporation, an internet service provider. He served as President of SBC-CATV, a cable television service provider, from 1999 until 2000, and as President of SBC Technology Resources, the applied research division of SBC Communications Inc., from 1997 until 1999. Prior to 1997, Mr. Roesslein served in executive officer positions with SBC Communications, Inc. and Southwestern Bell. Mr. Roesslein holds a bachelor’s degree in Mechanical Engineering from the University of Missouri-Columbia and a master’s degree in Finance from the University of Missouri-Kansas City. Mr. Roesslein is currently a director of Atlantic Tele-Network, Inc., a publicly traded company. The Board concluded that Mr. Roesslein should be nominated and serve as a director because he brings a wealth of financial and executive experience to the Board including extensive experience in the development of large accounts while serving Southwestern Bell Corporation’s customers. He also has a strong financial background, having served as Vice President and Chief Financial Officer of Southwestern Bell Publications and as Vice President and Chief Financial Officer of Southwestern Bell Telephone Company. Mr. Roesslein has an extensive high level background in the telecom industry and in telecom technologies. In 2015, he served as a member of the Audit Committee and a member of the Nomination and Governance Committee. He currently serves as a member of the Audit Committee and a member of the Nomination and Governance Committee. |

6

Chairman of the Board of Radian Corporation, both of which are environmental engineering firms. Dr. Carlton received his bachelor’s degree in Chemistry from the University of St. Thomas and his PhD in Chemistry from UT Austin. Dr. Carlton is a former director of American Electric Power and Temple-Inland, Inc., publicly traded companies.

The Board concluded that Dr. Carlton should serve as a director since he has a broad background as an executive and has significant experience in sales which is key to NI. He also has experience in the development of large accounts, marketing strategies, chemical process development, supply chain and inventory management, accounting and compliance with SEC matters, all of which skills the Board believes are important to have represented on the NI Board.

Charles J. Roesslein has been a member of NI’s Board of Directors since July 2000. Since 2004, Mr. Roesslein has been Chief Executive Officer of Austin Tele-Services, LLC, which is in the secondary market for telecom and IT assets. During 2000, Mr. Roesslein served as the Chairman of the Board of Directors and President of Prodigy Communications Corporation, an internet service provider. He served as President of SBC-CATV, a cable television service provider, from 1999 until 2000, and as President of SBC Technology Resources, the applied research division of SBC Communications Inc., from 1997 until 1999. Prior to 1997, Mr. Roesslein served in executive officer positions with SBC Communications, Inc. and Southwestern Bell. Mr. Roesslein holds a bachelor’s degree in Mechanical Engineering from the University of Missouri-Columbia and a master’s degree in Finance from the University of Missouri-Kansas City. Mr. Roesslein is currently a director of Atlantic Tele-Network, Inc., a publicly traded company.

The Board concluded that Mr. Roesslein should be nominated and serve as a director since he brings a wealth of financial and executive experience to the Board including extensive experience in the development of large accounts while serving Southwestern Bell Corporation’s customers. He also has a strong financial background having served as Vice President and Chief Financial Officer of Southwestern Bell Publications and as Vice President and Chief Financial Officer of Southwestern Bell Telephone Company. Mr. Roesslein has an extensive high level background in the telecom industry and in telecom technologies.

Duy-Loan T. Le has been a member of NI’s Board of Directors since September 2002. During her continuing 30-year career at Texas Instruments, Inc. (“TI”), in 2002, Ms. Le became the first woman at TI elected to the rank of Senior Fellow. Prior to this role, she held leadership positions throughout TI. Since 2000, she has been Digital Signal Processor (DSP) Advanced Technology Ramp Manager at TI, with responsibilities which include assisting with product execution on advanced technology nodes such as 180nm, 130nm, 90nm, 65nm, 40nm, and 28nm. Ms. Le is currently the Embedded Processing (EP) Rays Manager, responsible for technology readiness and product execution for TI’s multibillion-dollar digital business. Ms. Le has been awarded 24 patents and has 7 pending applications. She holds a bachelor’s degree in Electrical Engineering from the UT Austin and a master’s degree in Business Administration from the University of Houston.

The Board concluded that Ms. Le should be nominated and serve as a director since she has extensive experience managing platform-based product development. At TI, she oversees the definition of technology requirements, leads technology qualifications with the development teams, and directs execution to achieve functionality, performance, power, yield, quality, reliability and capacity goals to enable successful product launch and ramp. She has managed global R&D centers for TI; these teams span multiple countries, disciplines, businesses, and organizations across TI. She has over 20 years of process manufacturing experience. These skills and knowledge are relevant for NI’s business.

| Gerhard P. Fettweis, PhD, 54 - Director since March 2016; Vodafone Chair Professor at the Technical University of Dresden. Business Experience: Since September 1994, Dr. Fettweis has served as the Vodafone Chair Professor of Electrical Engineering at the Technical University of Dresden, where his research focuses on next generation wireless systems. In connection with that role, he has spun-out ten startup companies from the university. From August 2015 to February 2016, he served as a visiting professor at the University of California at Berkeley and as a senior researcher at the International Computer Science Institute. Dr. Fettweis is a member of the German National Academy of Science and Engineering and a fellow of the Institute of Electrical and Electronics Engineers (“IEEE”). He has received numerous awards, including a recognition award for outstanding technical contributions from the IEEE Wireless Communications Technical Committee and the Stuart Meyer Memorial Award from the IEEE Vehicular Technology Society, both in 2014. Dr. Fettweis has authored or co-authored two books and is listed as an inventor on over thirty issued patents. Dr. Fettweis received his Dipl.-Ing. in Electrical Engineering in 1986 and his PhD in Electrical Engineering in 1990, each from Aachen University of Technology. The Board concluded that Dr. Fettweis should serve as a director because of his strong technical background and extensive knowledge in electrical engineering, as well as his experience in science, technology and business. Additionally, he is very involved in the scientific community and has leadership and management experience through his role as the Vodafone Chair Professor at the Technical University of Dresden. He is a member of the Compensation Committee. |

There is no family relationship between any director, director nominee or executive officer of NI.

8

The following table sets forth the beneficial ownership of NI’s common stock as of the Record Date (i) by all persons known to NI, based on statements filed by such persons pursuant to Section 13(d) or 13(g) of the Exchange Act, to be the beneficial owners of more than 5% of NI’s common stock, (ii) by each of the executive officers named in the Summary Compensation Table under “Executive Compensation,” (iii) by each director and director nominee, and (iv) by all current directors and executive officers as a group:

Name of Person or Entity | Number of Shares (1) | Approximate Percentage Owned (2) | Number of Shares (1) | Approximate Percentage Owned (2) | ||||||||||||

James J. Truchard 11500 North Mopac Expressway Austin, Texas 78759 | 24,094,882 | (3) | 19.51% | 11,528,660 | (3) | 9.02% | ||||||||||

Capital World Investors 333 South Hope Street Los Angeles, California 90071 | 7,391,489 | (4) | 5.98% | |||||||||||||

Brown Advisory, Inc 901 South Bond Street, Suite 400 Baltimore, Maryland 21231 | 7,384,169 | (5) | 5.98% | |||||||||||||

Royce & Associates 745 Fifth Avenue New York, New York 10151 | 6,229,051 | (6) | 5.04% | |||||||||||||

James J. Truchard Marital Trust 3816 Hunterwood Point Austin, Texas 78746 | 10,770,347 | (4) | 8.43% | |||||||||||||

The Vanguard Group 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 7,892,128 | (5) | 6.17% | |||||||||||||

Brown Advisory, Inc. 901 South Bond Street, Suite 400 Baltimore, Maryland 21231 | 7,504,870 | (6) | 5.87% | |||||||||||||

BlackRock, Inc. 55 East 52nd Street New York, NY 10055 | 6,933,359 | (7) | 5.42% | |||||||||||||

Janus Capital Management LLC 151 Detroit Street Denver, Colorado 80206 | 6,813,314 | (8) | 5.33% | |||||||||||||

Jeffrey L. Kodosky | 2,854,571 | (7) | 2.31% | 2,103,201 | (9) | 1.65% | ||||||||||

Alexander M. Davern | 100,829 | (8) | * % | 90,897 | (10) | * % | ||||||||||

Peter Zogas, Jr. | 92,947 | (9) | * % | |||||||||||||

Eric H. Starkloff | 15,860 | (11) | * % | |||||||||||||

Scott A. Rust | 33,674 | (12) | * % | |||||||||||||

Charles J. Roesslein | 74,657 | (10) | * % | 91,513 | (13) | * % | ||||||||||

Duy-Loan T. Le | 67,129 | (11) | * % | 81,545 | (14) | * % | ||||||||||

Donald M. Carlton | 54,827 | (12) | * % | 52,683 | (15) | * % | ||||||||||

John K. Medica | 30,967 | (13) | * % | |||||||||||||

John M. Berra | 15,541 | (14) | * % | 28,397 | (16) | * % | ||||||||||

Phillip D. Hester. | 8,982 | (15) | * % | |||||||||||||

All executive officers and directors as a group (10 persons) | 27,393,832 | (16) | 22.16% | |||||||||||||

Michael E. McGrath | 9,550 | (17) | * % | |||||||||||||

Gerhard P. Fettweis | — | — | ||||||||||||||

All executive officers and directors as a group (11 persons) | 14,035,980 | (18) | 10.98% | |||||||||||||

| * | Represents less than 1% of the outstanding shares of our common stock. |

| (1) | Except as indicated in the footnotes to this table, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable. |

| (2) | For each individual and group included in the table, percentage owned is calculated by dividing the number of shares beneficially owned by such person or group as described above by the sum of the |

| of common stock that such person or group had the right to acquire on or within 60 days of March |

| (3) | Includes |

| (4) | The information as to beneficial ownership is based on a Schedule |

9

| (5) | The information as to beneficial ownership is based on a Schedule 13G/A filed with the SEC on February |

| (6) | The information as to beneficial ownership is based on a Schedule 13G/A filed with the SEC on |

| (7) | The information as to beneficial ownership is based on a Schedule 13G filed with the SEC on January 28, 2016, reflecting beneficial ownership as of December 31, 2015. The Schedule 13G states that BlackRock, Inc., and/or its subsidiaries have sole voting power with respect to 6,554,124 shares of common stock and sole dispositive power with respect to 6,993,359 shares of common stock. |

| (8) | The information as to beneficial ownership is based on a Schedule 13G filed with the SEC on February 16, 2016, reflecting beneficial ownership as of December 31, 2015. The Schedule 13G states that Janus Capital Management LLC and/or its subsidiaries have sole voting power with respect to 6,807,514 shares of common stock, shared voting power with respect to 5,800 shares of common stock, sole dispositive power with respect to 6,807,514 shares of common stock and shared dispositive power with respect to 5,800 shares of common stock. |

| (9) | Includes an aggregate of |

| (10) | Includes |

| (11) | Includes 7,721 shares subject to RSUs which vest within 60 days of March 11, 2016. |

| (12) | Includes 5,199 shares subject to RSUs which vest within 60 days of March 11, 2016. |

| (13) | Includes 4,223 shares subject to RSUs which vest within 60 days of March 11, 2016, and 1,500 shares held by Mr. Roesslein’s son. |

| Includes |

| (15) | Includes |

| (16) | Includes |

| (17) | Includes 4,448 shares subject to RSUs which vest within 60 days of March 11, 2016. |

| (18) | Includes 50,251 shares subject to RSUs which vest within 60 days of March 11, 2016. |

10

The Board of Directors of NI held a total of sixnine meetings during 2012.2015. The Board of Directors has a standing Audit Committee, Compensation Committee, and Nomination and Governance Committee.

NoEach director, other than Dr. Carlton, attended fewer thanat least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which he or she served. NI encourages, but does not require, its board members to attend NI’s annual meeting.meeting of stockholders. In 2012,2015, all directors, with the exception of Mr. McGrath and Dr. Carlton, Ms. Le and Mr. Medica, attended NI’s annual meeting.

The Board of Directors believes that NI’s Chief Executive Officer, Dr. Truchard, is best situated to serve as Chairman because he is the director most familiar with NI’s business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Dr. Truchard is also a founder of NI and NI’s largest stockholder. The Board’s independent directors and management directors have different perspectives and roles in strategic development. NI’s independent directors bring experience, oversight and expertise from outside the company and industry, while the Chief Executive Officer and the other management director bring company-specific experience and expertise. The Board of Directors believes that the combined role of Chairman and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and the Board of Directors, which are essential to effective governance. NI does not have a lead independent director.

The NI Board oversees risk management in a number of ways. The Audit Committee oversees the management of financial and accounting related risks as an integral part of its duties. Similarly, the Compensation Committee considers risk management when setting the compensation policies and programs for NI’s executive officers and other employees. The full Board of Directors receives reports on various risk related items at each of its regular meetings including risks related to NI manufacturing operations, intellectual property, taxes, products and employees. The Board also receives periodic reports on NI’s efforts to manage such risks through safety measures, insurance or self-insurance.

Communications to the Board of Directors

Stockholders may communicate with members of the Board of Directors by mail addressed to the Chairman, any other individual member of the Board, to the full Board, or to a particular committee of the Board. In each case, such correspondence should be sent to the following address: 11500 North Mopac Expressway, Building C, Austin, Texas 78759, Attention: Corporate Secretary. Correspondence received that is addressed to the members of the Board of the Directors will be reviewed by NI’s General Counsel or his designee, who will forward such correspondence to the appropriate members of the Board of the Directors.

TheDuring 2015, the Audit Committee which currently consistsconsisted of directors Donald M. Carlton, Charles J. Roesslein, and John M. Berra and met six times during 2012.times. Currently, the Audit Committee consists of directors Charles J. Roesslein, John M. Berra, Michael E. McGrath and Duy-Loan T. Le. The Audit Committee appoints, compensates, retains and oversees the engagement of NI’s independent registered public accounting

11

firm, reviews with such independent registered public accounting firm the plan, scope and results of their examination of NI’s consolidated financial statements and reviews the independence of such

independent registered public accounting firm. The Audit Committee maintains free and open communication with NI’s independent registered public accounting firm and the internal audit department, overseeing the internal audit function and NI’s management team. The Audit Committee inquires about any significant risks or exposures and assesses the steps management has taken to minimize such risks to NI, including the adequacy of insurance coverage and the strategy for management of foreign currency risk. The Audit Committee also reviews NI’s compliance with matters relating to environmental, Equal Employment Opportunity Commission, export and SEC regulations. The Audit Committee has established procedures forto promote and protect employee reporting of (i) suspected fraud or wrongdoing relating to accounting, auditing or financial reporting matters and (ii) complaints and concerns regarding a violation of the receipt, retentionfederal securities laws, including (A) receiving, retaining and treatment ofaddressing complaints received by NI regarding accounting, internal accounting controls or auditingrelating to such matters, and for NI(B) enabling employees to submit concerns regarding such matters on a confidential and anonymous basis.basis any concerns regarding such matters; and (C) protecting reporting employees from retaliation. The Board of Directors believes that each director who currently serves as a member of the Audit Committee or who served as a member of the Audit Committee in 2015 is an “independent director” as that term is defined by the Nasdaq listing standards and Rule 10A-3 of the Securities Exchange Act of 1934. The Board of Directors has determined that each of Dr. Carlton and Mr. Roesslein is an “audit committee financial expert” within the meaning of SEC rules. The charter of the Audit Committee is available on NI’s website at

http://www.ni.com/nati/corporategovernance/composition_charters.htm.

Nomination and Governance Committee

TheDuring 2015, the Nomination and Governance Committee which currently consistsconsisted of directors Charles J. Roesslein, Donald M. Carlton, and John M. Berra, each of whom was deemed to be an “independent director” as that term is defined by the Nasdaq listing standards, and met two times. Currently, the Nomination and Governance Committee consists of directors Charles J. Roesslein, John M. Berra, Michael E. McGrath and Duy-Loan T. Le, each of whom is deemed to be an “independent director” as that term is defined by the Nasdaq listing standards, met four times during 2012.standards. The Nomination and Governance Committee recommends to the Board of Directors the selection criteria for board members, compensation of outside directors, appointment of board committee members and committee chairpersons, and develops board governance principles. The Nomination and Governance Committee will consider nominees recommended by stockholders provided such recommendations are made in accordance with procedures described in this Proxy Statement under “Deadline for Receipt of Stockholder Proposals.” When considering a potential director candidate, the Nomination and Governance Committee looks for demonstrated character, judgment, relevant business, functional and industry experience, and a high degree of acumen. The Nomination and Governance Committee also considers issues of diversity, such as education, professional experience and differences in viewpoints and skills. The Nomination and Governance Committee does not have a formal policy with respect to diversity; however, the Board of Directors and the Nomination and Governance Committee believe that it is important that the members of the Board of Directors represent diverse viewpoints. The Nomination and Governance Committee’s process for identifying and evaluating nominees typically involves a series of internal discussions, review of information concerning candidates and interviews with selected candidates. There are no differences in the manner in which the Nomination and Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder. NI does not pay any third party to identify or assist in identifying or evaluating potential nominees. The charter of the Nomination and Governance Committee is available on NI’s website at

http://www.ni.com/nati/corporategovernance/composition_charters.htm.

12

TheDuring 2015, the Compensation Committee which currently consistsconsisted of directors Duy-Loan T. Le, John M. Berra, and John K. MedicaMichael E. McGrath, each of whom iswas deemed to be an “independent director” as that term is defined by applicable SEC rules, Nasdaq listing standards and other requirements, and met seven times during 2012.six times. Currently, the Compensation Committee consists of directors John M. Berra, Michael E. McGrath, Duy-Loan T. Le and Gerhard P. Fettweis, each of whom is deemed to be an “independent director” as that term is defined by applicable SEC

rules, Nasdaq listing standards and other requirements. The charter of the Compensation Committee is available on NI’s website at

http://www.ni.com/nati/corporategovernance/composition_charters.htm.

The Compensation Committee seeks input from NI’s President and Chief Executive Officer, Dr. Truchard, when discussing the performance of, and compensation levels for, executives other than himself. The Compensation Committee also works closely with Dr. Truchard and NI’s vice president of human resources and others as required in evaluating the financial, accounting, tax and retention implications of NI’s various compensation programs. The vice president of human resources regularly attends the meetings of the Compensation Committee and, at such meetings, provides advice on compensation matters to the Compensation Committee. The vice president of human resources also provides guidance to the Compensation Committee concerning compensation matters as they relate to NI’s executive officers. Neither Dr. Truchard, the vice president of human resources, nor any of NI’s other executives participates in deliberations relating to his own compensation.

Under the terms of its charter, the Compensation Committee establishes the compensation of NI’s Chief Executive Officer, evaluates the performance of NI’s executive officers, and establishes the salaries and cash bonus compensation of the executive officers based on recommendations of the Chief Executive Officer. The Compensation Committee also periodically examines NI’s compensation structure to evaluate whether NI is rewarding its officers and other personnel in a manner consistent with sound industry practices and makes recommendations on such matters to NI’s management and Board of Directors. The Compensation Committee also has oversight responsibility for NI’s 2015 Equity Incentive Plan (the “2015 Incentive Plan”), NI’s 2010 Incentive Plan (the “2010 Incentive Plan”), NI’s 2005 Incentive Plan (the “2005 Incentive Plan”), and Employee Stock Purchase Plan and Amended and Restated 1994 Incentive Plan. The Board of Directors may by resolution prescribe additional authority and duties to the Compensation Committee.

The Compensation Committee’s charter does not contain a provision providing for the delegation of its duties to other persons. The Compensation Committee has not delegated any of its authority.

Prior to 2011, NI had not historically utilizedFor a discussion of NI’s utilization of compensation consultants, in determining or recommending the amount or form of executive compensation. As discussed in thesee “Compensation Discussion and Analysis,Analysis.” NI uses survey information and compares its executive compensation levels with those of other technology companies in such survey that NI believes to be comparable in terms of market capitalization and annual revenue. In July 2011, the Compensation Committee engaged Frederic W. Cook & Co. as a compensation consultant to review NI’s overall executive compensation structure and to perform an analysis and assessment of NI’s compensation processes, methodologies and practices to evaluate their effectiveness and alignment with NI’s compensation philosophy and objectives.

13

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee are set forth in the “Compensation Committee” section of this proxy statement and do not include any NI executive officers. During 2012,2015, no NI executive officer served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on NI’s Compensation Committee. During 2012,2015, no NI executive officer served on the compensation committee (or equivalent) of another entity whose executive officer(s) served as a member of the NI Board of Directors.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Related Persons

NI had no related party transactions within the meaning ofrequiring disclosure under applicable SEC rules for the year ended December 31, 2012.2015 and has no such related party transaction currently proposed.

Policy and Procedures for Review, Approval, or Ratification of Related Party Transactions

Pursuant to its written charter, the Audit Committee is responsible for reviewing NI’s policies relating to the avoidance of conflicts of interests and past or proposed transactions between NI, members of the Board of Directors of NI, and management. NI considers “related person transactions” to mean all transactions involving a “related person,” which under SEC rules means an executive officer, director or a holder of more than five percent of NI’s common stock, including any of their immediate family members and any entity owned or controlled by such persons. The Audit Committee determines whether the related person has a material interest in a transaction and may approve, ratify, rescind or take other action with respect to the transaction in its discretion.

In any transaction involving a related person, NI’s Audit Committee would consider the available material facts and circumstances of the transaction, including: the direct and indirect interests of the related person; the risks, costs and benefits of the transaction to NI; whether any alternative transactions or sources for comparable services or products are available; and, in the event the related person is a director (or immediate family member of a director or an entity with which a director is affiliated), the impact that the transaction will have on such director’s independence.

After considering such facts and circumstances, NI’s Audit Committee determines whether approval, ratification or rescission of the related person transaction is in NI’s best interests. NI’s Audit Committee believes that all employees and directors should be free from conflicting interests and influences of such nature and importance as would make it difficult to meet their applicable fiduciary duties and loyalty to NI, and reviews all related party transactions against the foregoing standard.

NI’s written policies and procedures for review, approval or ratification of transactions that pose a conflict of interest, including related person transactions, are set forth in its Code of Ethics, which contains, among other policies, a conflicts of interest policy for all employees, including NI’s executives, and a conflicts of interest policy for non-employee directors.

Under NI’s written conflicts of interest policy applicable to all employees, including NI’s executives, every employee is required to report to NI’s President any information regarding the existence or likely development of conflicts of interest involving themselves or others within NI. While

14

NI provides examples of potential conflicts of interests, such as investments in enterprises that do business with NI, compensation for services to any person or firm which does business with NI, or gifts and loans and entertainment from any person or firm having current or prospective dealings with NI, the policy applicable to employees expressly states that the examples provided are illustrative only and that each

employee should report any other circumstance which could be construed to interfere actually or potentially with loyalty to NI. Transactions involving potential conflicts of interests for employees are reviewed by NI’s President, who makes a determination as to whether there exists any conflict of interest or relationship which violates NI’s policies and the appropriate actions to take with respect to such relationship. NI’s General Counsel reports to the Audit Committee the conflict of interest reports received and acted upon by the President. In the event a report was received concerning a potential conflict of the President or a member of the Board of Directors, the Audit Committee would review such matter.

The written conflicts of interest policy applicable to all non-employee directors is substantially similar to the conflicts of interest policy applicable to NI employees, with the exception that every non-employee director is required to report potential conflict of interest situations to the Audit Committee, which is responsible for making the determination as to whether there exists any conflict of interest or relationship which violates such policy. If the Audit Committee determines that a conflict of interest exists, the non-employee director involved will be required to dispose of the conflicting interest to the satisfaction of the Audit Committee.

15

Determining Compensation for Non-Employee Directors in 20122015

The Board of Directors, upon the recommendation of the Nomination and Governance Committee, sets non-employee directors’ compensation with the goal of retaining NI’s directors and attracting qualified persons to serve as directors. In developing its recommendations, the Nomination and Governance Committee considers director compensation at comparable publicly-traded companies and aims to structure director compensation in a manner that is transparent and easy for stockholders to understand.

The compensation of non-employee directors for the fiscal year ended December 31, 20122015 is set forth in the table below.

Director CompensationDIRECTOR COMPENSATION

For Fiscal Year Ended DecemberFOR FISCAL YEAR ENDED DECEMBER 31, 20122015

Name | Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards | Total | Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards | All Other Compensation | Total | |||||||||||||||||||||||||||

James J. Truchard (2) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||

Jeffrey L. Kodosky (3) | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Donald M. Carlton | 67,500 | 119,992 | — | 187,492 | 77,500 | 130,024 | — | — | 207,524 | |||||||||||||||||||||||||||

Charles J. Roesslein | 62,500 | 119,992 | — | 182,492 | 70,000 | 130,024 | — | — | 200,024 | |||||||||||||||||||||||||||

Duy-Loan T. Le | 65,000 | 119,992 | — | 184,992 | 70,000 | 130,024 | — | — | 200,024 | |||||||||||||||||||||||||||

John K. Medica | 60,000 | 119,992 | — | 179,992 | ||||||||||||||||||||||||||||||||

John M. Berra | 60,000 | 119,992 | — | 179,992 | 70,000 | 130,024 | — | — | 200,024 | |||||||||||||||||||||||||||

Michael E. McGrath | 62,500 | 130,024 | — | — | 192,524 | |||||||||||||||||||||||||||||||

| (1) | Amounts represent the dollar amount recognized for financial statement reporting purposes for |

| (2) | As an employee director, Dr. Truchard does not receive any additional compensation for his service as a director. His employee compensation is included in the Summary Compensation Table. |

| (3) | As an employee director, Mr. Kodosky does not receive any additional compensation for his service as a director. Mr. Kodosky is a Business and Technology Fellow, but not a named executive officer, as such term is defined under Item 402(a)(3) of Regulation S-K. Pursuant to SEC rules, the compensation that a director receives for services as a Business and Technology Fellow does not need to be reported in the table for Director Compensation. |

Discussion of Director Compensation

In 2012,2015, the annual compensation for NI’s non-employee directors was comprised of cash compensation in the form of an annual retainer, committee chair retainer, committee membership

retainer, and equity compensation in the form of RSUs. Each of these components is described below. An NI employee director does not receive any additional compensation for his service as a director.

16

Annual Board/Committee Retainer Fees

In 2015, the annual compensation for NI’s non-employee directors was comprised of cash compensation, payable quarterly, for membership on the board of directors and committees, as well as for committee chair positions. Non-employee directors receivedreceive an annual cash retainer of $60,000 per year, withplus $5,000 per year for membership on the Audit Committee Chair being paid an additional $7,500 annual retainer,and $2,500 per year for membership on each of the Compensation Committee Chair being paid an additional $5,000, and the Nomination and Governance Chair being paidCommittee. In addition, the chairpersons of the Audit Committee, Compensation Committee and Nomination and Governance Committee receive an additional $2,500.$15,000, $10,000 and $5,000 per year, respectively. An NI employee director does not receive any additional compensation for service as a director.

Non-Employee Director Reimbursement Practice

Non-employee directors are reimbursed for travel and other out-of-pocket expenses connected to Board travel.service.

Restricted Stock Unit Awards

Under NI’s 2010applicable Incentive Plan, non-employee directors are eligible to receive RSU grants. Specifically, each non-employee director receives an annual grant of RSUs equal to $120,000$130,000 divided by the closing price of NI’s common stock on the day immediately preceding the date of grant. Under this program,the 2010 Incentive Plan, in 2012, Mr.2015, Dr. Carlton, Mr. Roesslein, Ms. Le, Mr. Medica,Berra, and Mr. BerraMcGrath were each granted 4,4794,038 RSUs based on NI’s closing stock price of $26.79$32.20 per share on April 18, 2012. These21, 2015. The RSUs granted to Dr. Carlton, Mr. Roesslein, Ms. Le, Mr. Berra and Mr. McGrath vest over a three-year period with one-third of the RSUs vesting on each anniversary of the vesting commencement date, which is May 1 of each year.

17

The following table sets forth information concerning the persons serving as executive officers of NI as of the Record Date, including information as to each executive officer’s age, position with NI and business experience. Officers of NI serve at the discretion of the Board.

Name of Executive | Age | Position | ||||

James J. Truchard | Chairman of the Board of Directors, Chief Executive Officer, and President | |||||

Alexander M. Davern | Chief Operating Officer, Executive Vice President, Chief Financial Officer, and Treasurer | |||||

| Executive Vice President, Global Sales & Marketing | |||||

Scott A. Rust | 49 | Senior Vice President, | ||||

| ||||||

See “Election of Directors” for additional information with respect to Dr. Truchard.

Alexander M. Davern joined NI in February 1994 and currently serves as Chief Operating Officer, Executive Vice President, Chief Financial Officer and Treasurer. He previously served as NI’s Chief Financial Officer, Senior Vice President, IT and Manufacturing Operations and Treasurer from December 2002 to October 2010; as Chief Financial Officer and Treasurer from December 1997 to December 2002; as Acting Chief Financial Officer and Treasurer from July 1997 to December 1997; and as Corporate Controller and International Controller.Controller from February 1994 to July 1997. Prior to joining NI, Mr. Davern worked both in Europe and in the United States for the international accounting firm of Price Waterhouse, LLP. Mr. Davern received his bachelor’s degree in Commerce and a diploma in professional accounting from University College in Dublin, Ireland. Mr. Davern is a director of Helen of Troy and Cirrus Logic, Inc., both publicly traded companies.

Peter Zogas, Jr.Eric H. Starkloffjoined NI in 1985July 1997 and currently serves as SeniorExecutive Vice President, Global Sales and Marketing. He previously served as NI’s Senior Vice President Salesof Marketing from April 2013 to January 2014; Vice President of Marketing from November 2010 to March 2013; as Vice President of Product Marketing from October 2008 to October 2010; as Director of Product Marketing from August 2004 to September 2008; and as Product Marketing Manager from January 1998 to July 1996 to December 2002. His earlier positions with NI include National Sales Manager, Business Development Manager, Regional Sales Manager, and Sales Engineer. Prior to joining NI,2004. Mr. Zogas worked as an engineer at TI and, prior to that, at AT&T. Mr. ZogasStarkloff received his bachelor’s degree in Electrical Engineering from Drexel University.the University of Virginia.

Phillip D. HesterScott A. Rustjoined NI in 20091990 and currently serves as Senior Vice President, ofGlobal Research and Development. He previously served as the Senior Vice President and Chief Technology Officer at Advanced Micro Devices (AMD) from September 2005 to May 2008. Prior to AMD, he spent more than two decades working in a variety of leadership and management roles at IBM, including Chief Technology Officer andNI’s Vice President of Research and Development Test Systems from July 2013 to January 2014; as NI’s Vice President of Research and Technology for the PC divisionDevelopment in Penang, Malaysia from January 2011 to July 2013; as Vice President of Research and GeneralDevelopment of Modular Instruments from October 2008 to December 2010; as Director of Modular Instruments from March 2003 to September 2008; as Software Section Manager from October 2000 to March 2003; as Group Manager from October 1996 to October 2000; as Marketing Manager of the SystemsTest and Technology division, where he oversaw 1,500 employees globally.Measurement Software from August 1991 to September 1996; and as Applications Engineer from June 1990 to July 1991. Mr. Hester is also an entrepreneur, having founded a company that develops and manufactures easy-to-deploy server and storage technology for original equipment manufacturers. He has been a Director of ON Semiconductor since August 2006, and chairs the Science and Technology committee. Mr. HesterRust received both his bachelor’s and master’s degreesdegree in Electrical Engineering from UT Austin.Texas A&M University.

18

The following Compensation Discussion and Analysis (“CD&A”) should be read in conjunction with the compensation tables contained elsewhere in this proxy statement. References to our “named executive officers” in this CD&A are to the same persons set forth in the summary compensation tables.table.

Compensation Discussion and Analysis

Overview of Compensation Philosophy and Objectives

NI’s philosophy towards compensation for its principalnamed executive officer, principal financial officer and its other two executive officers who were serving at the end of 2012 reflects the following principles:

| • | Total compensation opportunities should be competitive. NI believes that its total compensation programs should be competitive so that NI can attract, retain and motivate talented executives. |

| • | Total compensation should be related to NI’s performance. NI believes that a significant portion of its executives’ total compensation should be directly linked to achieving specified financial objectives that NI believes will create stockholder value. |

| • | Total compensation should be related to individual performance. NI believes that executives’ total compensation should reward individual performance achievements and encourage individual contributions to NI’s performance. |

| • | Equity awards help executives think like stockholders. NI believes that executives’ total compensation should have a significant equity component because stock based equity awards help reinforce the executive’s long-term interest in NI’s overall performance and thereby align the interests of the executive with the interests of NI’s stockholders. |

| • | NI’s overall amount of equity awards should be related to its revenue growth. NI believes that its use of equity awards must be sensitive to the dilutive impact that such equity compensation will have on its stockholders. As a result, NI’s overall amount of equity awards for each year is linked to its revenue growth. |

| • | The same compensation programs should generally apply to both executive and non-executive employees whenever possible. NI values the contributions of all employees and, to the extent practicable, NI designs its compensation programs to apply to all employees. NI seeks to minimize the number of compensation programs that apply only to its executives and disfavors the use of executive perks. |

Determining Executive Compensation

In establishing NI’s overall program for executive compensation, the Compensation Committee works closely with NI’s senior management, including its Chief Executive Officer and Vice President of Human Resources. However, NI’s executives do not participate in any Board or Compensation Committee deliberations relating to their own compensation.

The Compensation Committee engaged Frederic W. Cook & Co. (“F.W. Cook”) as an independent consultant for 2011 compensation purposes. At that time, the Compensation Committee determined to engage an independent consultant every three years. Accordingly, the Compensation Committee again engaged F.W. Cook in 2014 to review NI’s overall executive compensation structure and perform an analysis and assessment of NI’s compensation processes, methodologies and practices to evaluate their effectiveness and alignment with NI’s compensation philosophy and objectives (as outlined above). As part of its analysis, the consulting firm reviewed compensation trends and developments, compensation levels for a number of companies that were comparable to NI in terms of market capitalization, industry

focus, revenue size and number of employees (including the Radford data used by NI in prior years as described below), NI executive compensation levels and certain disclosure and regulatory requirements.